Apollo micro systems share price target 2025

Apollo Micro Systems Share Price Target 2025, 2026, and 2030

Apollo Micro Systems Limited is an aeronautical, defence and space engineering company established in 1985. The company provides solutions in the design, development and assembly of custom-built electronics and electro-mechanical solutions. In this article, we will be looking at Apollo Micro Systems share price target 2025 and beyond, as well as the impact of the company's financial performance over the years.

Apollo Micro Systems Latest News

There was little movement in the apollo micro systems share price target 2024 . The share price of Apollo Micro Systems rose by a marginal margin of -0.41%. The stock closed at Rs110.80 on Friday, after opening at Rs110.35.

Apollo Micro Systems Share Price Target 2021-23

| Year | Maximum Target | MinimumTarget |

| 2021 | Rs 13.00 | Rs 4.00 |

| 2022 | Rs 29.00 | Rs 11.00 |

| 2023 | Rs 154.00 | Rs 27.00 |

(This prediction is based upon our understanding seeing the history of the above stock, expert advice is critical before making any investment-related commitment)

Apollo Micro Systems Share Price Target 2024

| Month (2024) | Maximum Target | MinimumTarget |

| January | ||

| February | ||

| March | ||

| April | Rs 120.60 | Rs 90.99 |

| May | Rs 125.61 | Rs 92.12 |

| June | Rs 131.56 | Rs 94.80 |

| July | Rs 137.80 | Rs 97.80 |

| August | Rs 144.90 | Rs 100.23 |

| September | Rs 149.43 | Rs 103.69 |

| October | Rs 154.15 | Rs 106.33 |

| November | Rs 158.00 | Rs 108.09 |

| December | Rs 162.41 | Rs 110.10 |

(Expert Advice is recommended before making any investment-related commitment)

Apollo Micro Systems Share Price Target 2025

| Month (2025) | Maximum Target | MinimumTarget |

| January | Rs 167.70 | Rs 114.20 |

| February | Rs 171.21 | Rs 117.90 |

| March | Rs 176.45 | Rs 120.50 |

| April | Rs 184.80 | Rs 123.56 |

| May | Rs 190.60 | Rs 125.72 |

| June | Rs 195.34 | Rs 126.79 |

| July | Rs 201.69 | Rs 128.71 |

| August | Rs 207.75 | Rs 131.92 |

| September | Rs 215.43 | Rs 134.48 |

| October | Rs 220.47 | Rs 137.95 |

| November | Rs 226.81 | Rs 139.38 |

| December | Rs 233.26 | Rs 140.40 |

(Expert Advice is recommended before making any investment-related commitment)

Apollo Micro Systems Share Price Target 2026 to 2030

| Year | Maximum Target | Minimum Target |

|---|---|---|

| 2026 | Rs 285.44 | Rs 164.70 |

| 2027 | Rs 343.60 | Rs 185.90 |

| 2028 | Rs 389.61 | Rs 207.35 |

| 2029 | Rs 450.91 | Rs 228.09 |

| 2030 | Rs 505.87 | Rs 251.12 |

(Apollo micro systems share price prediction is based upon our understanding seeing the history of the above stock, expert advice is critical before making any investment-related commitment

L&TFH: NSE Financials 2024

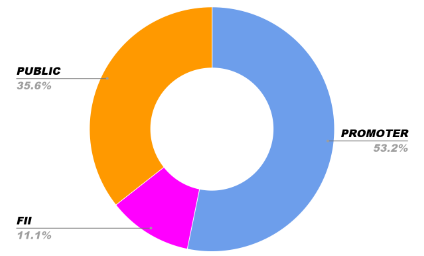

Apollo Micro Systems Market Capitalisation: Rs 3,314.41 cr INR

Apollo Micro Systems Reserves and Borrowings: Rs 491.15 cr INR and Rs 9.44 cr INR (March 2023) respectively.

Apollo Micro Systems 52 Week High-Low: Rs 161.70 - Rs 33.30

Apollo Micro Systems Ltd Financials 2024

| Revenue | 3.73B INR | ⬆ 25.52% YOY |

| Operating expense | 406.52M INR | ⬆ 22.54% YOY |

| Net Income | 311.20M INR | ⬆ 65.97% YOY |

| Net Profit Margin | 8.32 | ⬆ 32.22% YOY |

| Earnings Per Share | 1.16 | |

| EBITDA | 856.92M | ⬆ 33.43% YOY |

| Effective Tax Rate | 29.45% | |

| Total Assets | 9.56B INR | ⬆ 38.06% YOY |

| Total Liabilities | 4.37B INR | ⬆ 41.69% YOY |

| Total Equity | 5.19B INR | |

| Return on assets | 5.64% | |

| Return on Capital | 7.46% | |

| P/E Ratio | 95.52 | |

| Dividend Yield | 0.023% |

Apollo Micro Systems LTD Competitors (Market Cap: 3,314.41 crores INR)

- Hindustan Aeron Market Cap: 345,532.64 cr INR

- Bharat Elec Market Cap: 217,246.63 cr INR

- Data Patterns Market Cap: 17,017.73 cr INR

- Azad Eng Market Cap: 8,473.26 cr INR

Points to consider before investing in Apollo Micro Systems NSE Stock

The main competition of apollo micro systems share price target is with the leading companies in and within the industries in which it operates. The market capitalisation of the top 10 companies is dominated by the market capitalisation of big players such as BHEL (Bharat Electronics Limited) and HN aeronautics. Data patterns and Azad engineering are relatively smaller companies compared to the top 10 companies. The future of Apollo Micro Systems company’s defense stock depends on a few key factors like the management’s ability to win significantly larger contracts from Government entities impacting the defense industry.

Second, thanks to the solutions offered by Apollo Micro Systems, the company might feel the need to innovate more effectively and attractively than it can in all of the industries in which it operates. Apollo micro systems share price prediction can boost the business prospects of Apollo Micro Systems in the future and investors will be able to find their bullish outlook on this stock.

APOLLO MICROSOFT SYSTEMS ANNUAL RESULTS FOR FISCAL YEAR 2024 OUT NOW FOR THE INVESTORS TO DECIDE THEIR NEXT STEPS. In FY24, revenue and net profit of Apollo Micro Systems showed good growth at Rs 3,73,000,000 and Rs 311,20,000,000 respectively. The apollo micro systems share price target annual financial results show good positive response in the aftermath of the coronavirus pandemic and consistent growth in revenue and net profit.

Conclusion

The share price of Apollo Micro Systems started its journey in 2018 and so far, it has been able to increase its trajectory after a relatively stable one until mid-2023, whereas the initial share price of the stock on the NSE was Rs 37 in 2018 and it has only reached Rs 53 after more than five and a half years of trading on the NSE.

Since October 2023, the share prices of Apollo Micro Systems have started appreciating and the stock value has increased by more than +100%. As per the trend, the stock price of Apollo Micro Systems has risen by more than +220% since May 26th, 2023 at Rs 34.00 per share. However, it is important to note that following the stock market trend blindly can be risky. Therefore, it is advisable to seek the advice of an expert. Therefore, India Property Dekho strongly recommends investing in Apollo Micro Systems after thorough research and analysis.

FAQ

- What is the Apollo Micro Systems Share Price Target 2025?

- Apollo Micro Systems Share Price Target 2025 is between Rs 233 and Rs 114.

- What is the Apollo Micro Systems Share Price Target 2026?

- Apollo Micro Systems Share Price Target for the year 2026 is between Rs 285 and Rs 164.

- What is the NSE Apollo Micro Systems Share Price Target 2030?

- Apollo Micro Systems Share Price Target 2030 is predicted to remain between Rs 505 and Rs 251.

- What is the NSE Apollo Micro Systems Share Price Target 2024?

- Apollo Micro Systems Share Price Target 2024 is between Rs 162 and Rs 90.

Comments

Post a Comment